Supplier finance file formats

The PaymentsPlus solution utilises payee business and invoice data received from your ERP system(s). PaymentsPlus generates and schedules payments to be used in settlement instruction files that are sent to various payment channels available within the bank.

St. George customers

The Supplier Finance module is not available to customers of St. George.Interface specification

Using payee business and invoice data is a departure from typical payables solutions which rely on "payment" files which normally only allow same or next day settlement instructions. The portal will instead organise future dated invoice data such that a payment schedule is automatically maintained which gives both clients and their payee's a better opportunity to forecast their payables/receivables.

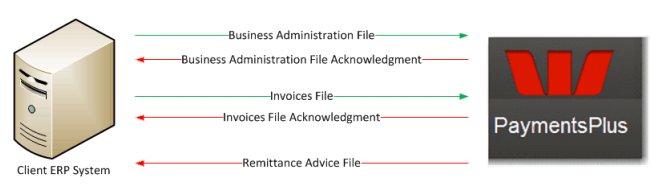

This page outlines the interface requirements for the implementation. It describes the main interfaces between the client's ERP system(s) and Westpac's Payments Plus platform.

File exchange summary

| File | Sender | Receiver | Frequency | Notes |

|---|---|---|---|---|

| Business Administration File | Client | PaymentsPlus | Weekly | |

| Business Administration Response File | PaymentsPlus | Client | Sent in response to a Business Administration File. | |

| Invoices File | Client | PaymentsPlus | Daily | |

| Invoices Response File | PaymentsPlus | Client | Sent in response to a Invoice File. | |

| Remittance Advice File | PaymentsPlus | Client | Daily | Sent on payment anniversary dates. |

Business administration file

This file provides the details of the supplier businesses which the Customer wishes to load onto the PaymentsPlus Platform. The file includes the ability to enable/disable both businesses and accounts for businesses.

The Supplier Business Record is processed with all its accompanying address and account records. If a validation error occurs in any of those records then the entire group of records will be rejected. If a problem is found with a specific supplier processing will still continue and action any other valid supplier changes in the Business Administration File.

The expected filename format for a Business Administration File is the concatenation of some static information with the current date and file sequence number.

i.e. WBC_BAM_YYYYMMDD_##.TXT

| Type | Description | Comment |

|---|---|---|

| 1 | File Control Header Record | One record per file. |

| 5 | Supplier Business Record | One record per Customer supplier. |

| 6 | Supplier Business Address | One record per Customer supplier. |

| 7 | Supplier Business Account Record | One or more account records for Customer supplier. |

| 9 | File Control Footer Record | One record per file. |

1 - File Control Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 1 |

Record Type |

| 2 | File Creation Date | 2 | 8 | Yes | Date YYYYMMDD |

The date the Customer created this file. |

| 3 | File Creation Time | 10 | 4 | Yes | Time HHMM |

The time the Customer created this file. |

| 4 | Customer Code | 14 | 10 | Yes | Char Left Justified Space Filled | Customer Code as provided by Westpac. This code uniquely identifies the client organisation within the PaymentsPlus platform. |

| 5 | Customer Name | 24 | 30 | Yes | Char Left Justified Space Filled | Customer Name as provided by Westpac (for human readable purposes only). |

| 6 | File Identifier | 54 | 17 | Yes | Char Left Justified Space Filled | A unique identifier for the file - this should be formatted as the text BAM followed by the file creation date and time. BAMYYYYMMDDHHmmss |

| 7 | File Type | 71 | 10 | Yes | Char Left Justified Space Filled | Code to indicate if the file should be processed as a changes or refresh file, acceptable values are: REFRESH, CHANGES. |

5 - Supplier Detail record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 5 |

Record Type |

| 2 | Reserved | 2 | 4 | No | BLANK | Reserved for response file. |

| 3 | Supplier Code | 6 | 15 | Yes | Char Left Justified Space Filled | The unique customer number of the supplier within the customers ERP system. It must contain only letters and numbers. |

| 4 | Supplier Name | 21 | 50 | Yes | Char Left Justified Space Filled | The name of the supplier. |

| 5 | Supplier Business Number | 71 | 20 | Yes | Number Left Justified Space Filled | The expected value of field is based on the 'Supplier Domiciled Country' field. If the 'Supplier Domiciled Country' field is AU or blank, then the 'Supplier Business Number' must be the Australian Business Number (ABN) for the supplier. This should be provided without spaces within the number. If the 'Supplier Domiciled Country' field is NZ, then the 'Supplier Business Number' must be the New Zealand IRD/GST Number. |

| 6 | Supplier Email Address | 91 | 50 | Yes | Char Left Justified Space Filled | The group email address for the supplier. This is the email address which will be used to contact the supplier when

|

| 7 | Supplier Phone Number | 141 | 20 | No | Char Left Justified Space Filled | The business phone number. |

| 8 | Supplier Mobile Phone Number | 161 | 20 | No | Char Left Justified Space Filled | The business mobile phone number. |

| 9 | Supplier Fax Number | 181 | 20 | No | Char Left Justified Space Filled | The business fax number. |

| 10 | Supplier Domiciled Country | 201 | 2 | No | Char Left Justified Space Filled | Two (2) character country code identifying the country which specifies the expected account types and invoice currency for the supplier. Acceptable values - AU, NZ. Defaults to AU if no value is provided. |

| 11 | Supplier Group | 203 | 1 | No | Char Left Justified Space Filled | The supplier group to which the supplier belongs. This group will dictate the terms and discount rate applied to this supplier. Acceptable values: 1, 2, 3, 4, 5. By default if no value is supplied the supplier will be placed in Tier '1'. |

| 12 | Enabled Flag | 204 | 1 | No | 0 or 1 or Blank |

Flag to indicate whether the business is enabled or not. 1 = Supplier enabled within the PaymentsPlus Platform, 0 = Supplier disabled within the PaymentsPlus Platform. Defaults to disabled if this value is not provided. |

| 13 | Discounting Limit | 205 | 3 | No | Number 0 - 100 | For customers who offer Supplier Finance to their customers, a 'Discounting Limit' value may be provided to limit their discounting.

|

6 - Supplier Address record

The Supplier Code must match the previous 5 record supplier code or the entire supplier will be rejected.

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 6 |

Record Type |

| 2 | Supplier Code | 2 | 15 | Yes | Char Left Justified Space Filled | The unique customer number of the supplier within the Customer ERP. |

| 3 | Street 1 | 17 | 50 | No | Char Left Justified Space Filled | The first address line for the supplier. |

| 4 | Street 2 | 67 | 50 | No | Char Left Justified Space Filled | The second address line for the supplier. |

| 5 | City | 117 | 50 | No | Char Left Justified Space Filled | The city of the address for the supplier. |

| 6 | Postcode | 167 | 5 | No | Char Left Justified Space Filled | The postal code of the address for the supplier. |

| 7 | State | 172 | 3 | No | Char Left Justified Space Filled | Australian postal state of the address for the supplier. Must be one of ACT, NSW, NT, QLD, SA, TAS, VIC or WA. This field should be omitted for New Zealand addresses. |

7 - Australian Supplier Account record

The Supplier Code must match the previous 5 record supplier code or the account will be rejected. There may be zero or more Accounts for a supplier.

A 7 account record type is processed as an Australian Supplier Account record based on the 'Supplier Domiciled Country' field specified on the preceding 5 supplier record. If this value is set to AU or blank then the 7 record is processed as an Australian Supplier Account record.

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 7 |

Record Type |

| 2 | Supplier Code | 2 | 15 | Yes | Char Left Justified Space Filled | The unique customer number of the supplier within customer ERP. |

| 3 | BSB | 17 | 7 | Yes | Number BBS-SBB | The bank/state/branch code for the supplier account. |

| 4 | Account Number | 24 | 15 | Yes | Number Left Justified Space Filled | The account number for the supplier account. |

| 5 | Enabled | 39 | 1 | No | 0 or 1 or Blank |

Flag to indicate whether the account is enabled or not. 1 = Enabled, 0 = Disabled. 'Enabled' will be set as 1 if not provided. |

| 6 | Default Account | 40 | 1 | No | 1 or Blank |

Flag to indicate which of the accounts for a supplier is the default account to be credited should they not select invoices for early financing. The default account must be enabled. There can only be one default account. If the default account is not specified, there can be at most one enabled account and it will be set as the default account. |

7 - New Zealand Supplier Account record

The Supplier Code must match the previous 5 record supplier code or the account will be rejected. There may be zero or more Accounts for a supplier.

A 7 account record type is processed as a New Zealand Supplier Account record based on the 'Supplier Domiciled Country' field specified on the preceding 5 supplier record. If this value is NZ then the 7 record is processed as a New Zealand Supplier Account record.

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 7 |

Record Type |

| 2 | Supplier Code | 2 | 15 | Yes | Char Left Justified Space Filled | The unique customer number of the supplier within customer ERP. |

| 3 | Bank Code | 17 | 2 | Yes | Number | The New Zealand account bank code. |

| 4 | Branch Code | 19 | 4 | Yes | Number | The New Zealand account branch code. |

| 5 | Reserved | 23 | 1 | No | Reserved | (ignored during processing) |

| 6 | Account Number | 24 | 7 | Yes | Number Right Justified Zero Filled | The New Zealand account number. |

| 7 | Reserved | 31 | 2 | No | Reserved | (ignored during processing) |

| 8 | Suffix | 33 | 2 | Yes | Number Right Justified Zero Filled | The New Zealand account suffix. |

| 9 | Filler | 35 | 4 | No | Blank | Unused account record space. Reserved for future use. |

| 10 | Enabled | 39 | 1 | No | 0 or 1 or Blank |

Flag to indicate whether the account is enabled or not. 1 = Enabled, 0 = Disabled 'Enabled' will be set as 0 if not provided |

| 11 | Default Account | 40 | 1 | No | 1 or Blank |

Flag to indicate which of the accounts for a supplier is the default account to be credited should they not select invoices for early financing. The default account must be enabled. There can only be at most one default account. If the default account is not specified, there can be at most one enabled account and it will be set as the default account. |

9 - File Control Footer record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 9 |

Record Type |

| 2 | Supplier Record Count | 2 | 8 | Yes | Number Right Justified Zero Filled | The count of all 5 records in the file. Used for validation purposes. The entire file will be rejected if this check does not validate correctly. |

| 3 | Address Record Count | 10 | 8 | Yes | Number Right Justified Zero Filled | The count of all 6 records in the file. Used for validation purposes. The entire file will be rejected if this check does not validate correctly. |

| 5 | Account Record Count | 18 | 8 | Yes | Number Right Justified Zero Filled | The count of all 7 records in the file. Used for validation purposes. The entire file will be rejected if this check does not validate correctly. |

Sample file

1201102280000WBC003 WBC003 BAM20110228020000CHANGES

5 WBC003SUP01 WBC003SUP01 28099908639 test@test.com 0299043311 0423000000 0299043852 1

6WBC003SUP01 50 Yeo St NEUTRAL BAY 2089 NSW

7WBC003SUP01 032-000000008 11

5 WBC003SUP02 WBC003SUP02 28099908639 test@test.com 0299043311 0423000000 0299043852 1

6WBC003SUP02 50 Yeo St NEUTRAL BAY 2089 NSW

7WBC003SUP02 032-000000007 11

5 WBC003SUP03 WBC003SUP03 28099908639 test@test.com 0299043311 0423000000 0299043852 1

6WBC003SUP03 50 Yeo St NEUTRAL BAY 2089 NSW

7WBC003SUP03 032-000000007 11

5 WBC003SUP04 WBC003SUP04 28099908639 test@test.com 0299043311 0423000000 0299043852 1

6WBC003SUP04 50 Yeo St NEUTRAL BAY 2089 NSW

7WBC003SUP04 032-000000007 11

5 WBC003SUP05 WBC003SUP05 28099908639 test@test.com 0299043311 0423000000 0299043852 1

6WBC003SUP05 50 Yeo St NEUTRAL BAY 2089 NSW

7WBC003SUP05 032-000000007 11

900000005000000050000000500000000Business administration response file

This file provides an acknowledgement of a Business Administration File, detailing the failure of any records in the file. A Business Administration Response File will be generated for each Business Administration File received by PaymentsPlus.

The filename format for a Business Administration Response File is the concatenation of some static information with the current date and file sequence number. This date and sequence number will match the values provided in the Business Administration File filename.

i.e. WBC_BAM_YYYYMMDD_##.ACK

| Type | Description | Comment |

|---|---|---|

| 1 | File Control Header Record | One record per file. |

| 0 | Error Record | One record per error found. Zero if no errors were found. |

| 9 | File Control Footer Record | One record per file. |

1 - File Control Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 1 |

Record Type |

| 2 | File Creation Date | 2 | 8 | Yes | Date YYYYMMDD |

Customer file creation date as provided in the Business Administration File. See File Header Record |

| 3 | File Creation Time | 10 | 4 | Yes | Time HHMM |

Customer file creation time as provided in the Business Administration File. See File Header Record |

| 4 | Customer Code | 14 | 10 | Yes | Char Left Justified Space Filled | Customer Code as provided in the Business Administration File. See File Header Record |

| 5 | File Identifier | 24 | 17 | Yes | Char Left Justified Space Filled | File Identifier as provided in the Business Administration File. See File Header Record |

0 - Error record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 0 |

Record Type |

| 2 | Line Number | 2 | 8 | Yes | Number Right Justified Zero Filled | The line number of the record in the provided Business Administration File that the error occurred on. |

| 3 | Response Code | 10 | 3 | Yes | Char Left Justified Space Filled | For rejected businesses, a 3 character response code will be provided. See Invoice File Processing Response Codes for the full list of rejection codes. |

| 4 | Field Name | 13 | 25 | Yes | Char Left Justified Space Filled | The Field Name of the field that contained the error. See Business Administration File |

| 5 | Error Description | 38 | 163 | Yes | Char Left Justified Space Filled | A human readable description of the error. |

| 6 | Supplier Code | 201 | 15 | No | Char Left Justified Space Filled | The unique customer number of the supplier within customer ERP. |

9 - File Control Footer record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 9 |

Record Type |

| 2 | Error Record Count | 2 | 8 | Yes | Number Right Justified Zero Filled | The count of all 0 records in the file. Used for validation purposes. |

Sample file

1 WBC003

000000004ACCAccount Invalid BSB/Account was provided.

900000001Invoices file

This file is used to provide outstanding Invoices which are payable to suppliers. The file provides the ability to load credit note invoices as well as withdraw invoices that have not been financed or paid.

This file is intended to add or remove invoices from the system - it is not intended to be used as a full refresh of all Invoices.

The filename format for an Invoices File is the concatenation of some static information with the current date and file sequence number.

i.e. WBC_INV_YYYYMMDD_##.TXT

| Type | Description | Comment |

|---|---|---|

| 1 | File Control Header Record | One record per file. |

| 5 | Invoice Record | One record per Customer approved invoice. |

| 9 | File Control Footer Record | One record per file. |

1 - File Control Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 1 |

Record Type |

| 2 | File Creation Date | 2 | 8 | Yes | Date YYYYMMDD |

The date the Customer created this file. |

| 3 | File Creation Time | 10 | 4 | Yes | Time HHMM |

The time the Customer created this file. |

| 4 | Customer Code | 14 | 10 | Yes | Char Left Justified Space Filled | Customer Code as provided by Westpac. This code uniquely identifies the client organisation within the PaymentsPlus Platform. |

| 5 | Customer Name | 24 | 30 | Yes | Char Left Justified Space Filled | Customer Name as provided by Westpac (for human readable purposes only). |

| 6 | File Identifier | 54 | 16 | Yes | Char Left Justified Space Filled | A unique identifier for the file - this should be formatted as the text 'OI' followed by the file creation date and time. I.e. OIYYYYMMDDHHmmss |

| 7 | Due Date | 70 | 8 | Yes | Date YYYYMMDD |

Due date of the invoices. This is the date that the Customer will be debited by Westpac and suppliers will be paid if they do not choose to offer invoices for early discount. If the day is not a banking day it will be rolled forward to the next banking day. This field can be overridden on a per invoice level with the Invoice Record Invoice Due Date field. The minimum acceptable date is the current processing date; the maximum acceptable date will be agreed with the Customer during implementation. If the file Due Date is not within these two dates then the entire file will be rejected. |

| 8 | File Invoice Sign | 78 | 1 | No | + or - or Blank |

By default, + indicates an invoice, - indicates a credit note. However, if the file invoice sign is negative (-), this is reversed (+credit notes, -invoice) for all payments in the file. |

| 9 | File Type | 79 | 10 | Yes | Char Left Justified Space Filled | Code to indicate if the file should be processed as a changes or refresh file, acceptable values are: REFRESH or CHANGES |

5 - Invoice record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 5 |

Record Type |

| 2 | Supplier Code | 2 | 15 | Yes | Char Left Justified Space Filled | The unique customer number of the supplier within the customer ERP. This must match a previously loaded supplier. |

| 3 | Invoice Number | 17 | 25 | Yes | Char Left Justified Space Filled | Unique invoice number for the given supplier. |

| 4 | Invoice Amount Sign | 42 | 1 | Yes | + or - |

See File Invoice Sign (File Control Header Record) for further details on what to populate in this field. Default + for invoice - for credit note. |

| 5 | Invoice Amount | 43 | 10 | Yes | Number Right Justified Zero Filled | Invoice amount in cents. |

| 6 | Currency | 53 | 3 | Yes | Char Left Justified Space Filled | ISO standard 3 letter currency code. Accepted values are AUD and NZD. |

| 7 | Invoice Date | 56 | 8 | Yes | Date YYYYMMD | The date the invoice was raised by the supplier. |

| 8 | Invoice Due Date | 64 | 8 | No | Date YYYYMMDD or Blank |

This optional field performs the same function as the 'Due Date' in the File Control Header Record. This field can be used to override the due date of each specific invoice to a different value to that which is provided in the header. This is the date that the Customer will be debited by Westpac for this specific invoice. This day must be a banking day - if the day is not a banking day it will be rolled forward to the next banking day. The minimum acceptable date is the current processing date provided the file is received prior to 4pm AEST. The maximum acceptable date is the processing date + 180 days. If the Invoice Due Date is not within these two dates then the entire file will be rejected. |

| 9 | Customer Reference | 72 | 16 | No | Char Left Justified Space Filled | Customer ERP reference field. |

| 10 | Withdraw Flag | 88 | 1 | No | 1 or Blank |

This flag allows the Customer to withdraw an invoice from the PaymentsPlus platform. There are many reasons why an invoice may not be able to be withdrawn from PaymentsPlus - refer to Invoice File Processing Response Codes for further details. Values 1 - Indicator to withdraw the invoice from the PaymentsPlus Platform Blank - the invoice will be added to PaymentsPlus. |

| 11 | Funding BSB Number | 89 | 7 | No | Number BBS-SBB | The bank/state/branch code for the funding account. |

| 12 | Funding Account Number | 96 | 9 | No | Number Left Justified Space Filled | The account number for the funding account. |

9 - File Control Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 9 |

Record Type |

| 2 | Invoice Record Count | 2 | 8 | Yes | Number Right Justified Zero Filled | Count of all 5 records in the file. Used for validation purposes. The entire file will be rejected if this check does not validate correctly. |

| 3 | Total Invoice Amount Sign | 10 | 1 | Yes | + or - |

Total invoice amount sign for all invoices in this file. Used for validation purposes. The entire file will be rejected if this check does not validate correctly. |

| 4 | Total Invoice Amount | 11 | 12 | Yes | Number Right Justified Zero Filled | Total net invoice amount of all invoices and credit notes in the file. I.e. Assuming a File Invoice Sign of + it would be the sum of all invoices minus the sum of all credit notes. Used for validation purposes. The entire file will be rejected if this check does not validate correctly. |

Invoice file processing response codes

| Response Code | Failure Description | Comments |

|---|---|---|

DTC |

Duplicate "File Identifier" found | If an invoice file is provided with the same "File Identifier" then the entire file will be rejected with this response code. |

DUP |

Duplicate "Invoice Number" | found If an invoice with the same "Invoice Number" for the given supplier already exists (from a previous file or earlier in the current file) then any subsequent invoices will be rejected with this response code. |

EOF |

Unexpected End Of File | This error will be raised if the file ends in an unexpected manner. |

FVE |

Footer validation error | This error will be raised if any of the values provided in the File Control Footer Record do not match the values calculated by PaymentsPlus. |

IFD |

Invalid file "Due Date" found | The file "Due Date" provided could not be correctly or is outside the allowable threshold of days from the current date. |

ILF |

Invalid line format found | This error will be raised in various circumstances and the description will provide further details. This may be raised if, a required field is missing, a field does not pass validation or a record is found in the incorrect order. |

NBA |

No account exists for buyer | This error will be raised if your company has not been correctly configured in PaymentsPlus and does not have the appropriate accounts configured. |

NBF |

Invalid "Customer Code" | If an invoice file is provided where the File Control Header Record "Customer Code" does not match the value provided by Westpac then the file will be rejected with this response code. |

NEG |

Rejected due to net negative payable amount | If more credit note value is provided than invoice value for a given due date and supplier, then the invoices for that supplier will be rejected with this response code. |

NSA |

Supplier has no enabled accounts | If an invoice is provided for a supplier that does not have an enabled account in the PaymentsPlus platform, then the invoice will be rejected with this response code. |

NSF |

No matching supplier code found | If an invoice is provided with an Invoice Record "Supplier Code" that cannot be matched to an existing Supplier Code in PaymentsPlus, then the invoice will be rejected with this response code. |

REJ |

Rejected due to other failures in file | This response code will be returned if an individual invoice has been rejected due to other errors in the file preventing the whole file from being processed. |

ULT |

Unknown line record type | A file will be rejected if a "Record Type" does not match one of the valid values. |

WID |

Invalid data found when attempting to withdraw invoice | This error code will be returned if an invoice could not be withdrawn. Typically this will be because the invoice details provided during the withdrawal process do not match the invoice values originally provided when the invoice was first loaded. |

WIM |

No invoice found when attempting to withdraw invoice This error code will be returned if an attempt to withdraw an invoice that does not exist in PaymentsPlus. WNN Withdrawing invoice would result in net negative payable amount This error code will be returned if an attempt to withdraw an invoice would result in a batch for a particular Due Date would result in a net negative payable amount. WSC Invoice cannot be withdrawn as it has already been financed This error code will be returned if an attempt to withdraw an invoice is made against an invoice that was already been offered for sale by the supplier. | |

ZDI |

Zero dollar invoice rejected This error code will be returned if a zero dollar invoice appears in a file. |

Sample file

1201103310000WBC003 WBC003 OI2011033101000020130630-CHANGES

5WBC003SUP01 Inv_002001 +0000001000AUD20101201 002001

5WBC003SUP01 Inv_002002 +0000001100AUD20101201 002002

5WBC003SUP01 Inv_002003 +0000001200AUD20101201 002003

5WBC003SUP06 Inv_002004 -0000001200AUD20101201 002004

900000004+000000000002100Invoices response file

This file provides an acknowledgement of an Invoices File, detailing the failure of any records in the file.

An Invoice Response File will be generated for each Invoice File received by PaymentsPlus.

The filename format for an Invoices Response File is the concatenation of some static information with the current date and file sequence number. This date and sequence number will match the values provided in the Invoices File filename.

i.e. WBC_INV_YYYYMMDD_##.ACK

| Type | Description | Comment |

|---|---|---|

| 1 | File Control Header Record | One record per file. |

| 0 | Error Record | One record per error found. Zero if no errors were found |

| 9 | File Control Footer Record | One record per file. |

1 - File Control Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 1 |

Record Type |

| 2 | File Creation Date | 2 | 8 | Yes | Date YYYYMMDD | File Creation Date as provided in the Invoices File. See File Control Header Record |

| 3 | File Creation Time | 10 | 4 | Yes | Time HHMM | File Creation Time as provided in the Invoices File. See File Control Header Record |

| 4 | Customer Code | 14 | 10 | Yes | Char Left Justified Space Filled | Customer Code as provided in the Invoices File. See File Control Header Record |

| 5 | File Identifier | 24 | 16 | Yes | Char Left Justified Space Filled | File Identifier as provided in the Invoices File. See File Control Header Record |

0 - Error record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 0 |

Record Type |

| 2 | Line Number | 2 | 8 | Yes | Number Right Justified Zero Filled | The line number of the record in the provided Invoice File that the error occurred on. |

| 3 | Response Code | 10 | 3 | Yes | Char Left Justified Space Filled | For rejected invoices, a 3 character response code will be provided. See Invoice File Processing Response Codes for the full list of rejection codes. |

| 4 | Field Name | 13 | 25 | Yes | Char Left Justified Space Filled | The Field Name of the field that contained the error. See Business Administration File |

| 5 | Error Description | 38 | 163 | Yes | Char Left Justified Space Filled | A human readable description of the error. |

| 6 | Invoice Number | 201 | 25 | No | Char Left Justified Space Filled | Unique invoice number for the given supplier. |

| 7 | Customer Reference | 226 | 16 | No | Char Left Justified Space Filled | Customer ERP reference field. |

9 - File Control Footer record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 9 |

Record Type |

| 2 | Error Record Count | 2 | 8 | Yes | Number Right Justified Zero Filled | The count of all 0 records in the file. Used for validation purposes. |

Sample file

1201103310000WBC003 OI20110331010000

000000005SUPSupplierCode Supplier business not found

900000001Remittance advice file

The Remittance Advice File notifies the customer of invoices which have been financed to the customer's supplier, as well as paid by the customer. It also serves as the mechanism to report failed credits to the customer.

Each Remittance Advice File may contain information about one or more of the following,

- Successfully early financed payments to suppliers.

- Successful repayments by the customer for early financed payments to suppliers.

- Successful maturity payments by the customer directly to the supplier.

Dishonoured payments corresponding to any of the three situations mentioned above may also occur and will be reported in a separate Remittance Advice File.

The filename format for a Remittance Advice File is the concatenation of some static information with the transaction date and file sequence number.

i.e. WBC_RA_YYYYMMDD_##.TXT

| Type | Description | Comment |

|---|---|---|

| 1 | File Control Header Record | One record per file |

| 3 | Batch Header Record | One or more records per payment type |

| 5 | Invoice Detail Record | One or more record per batch (one per supplier invoice paid) |

| 7 | Batch Footer Record | One per Batch Header Record |

| 9 | File Control Footer Record | One record per file |

1 - File Control Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 1 |

Record Type |

| 2 | File Creation Date | 2 | 8 | Yes | Date YYYYMMDD | The date PaymentsPlus generated the file. |

| 3 | File Creation Time | 10 | 4 | Yes | Time HHMM | The time PaymentsPlus generated the file. |

| 4 | Customer Code | 14 | 10 | Yes | Char Left Justified Space Filled | Customer Code as provided by Westpac. This code uniquely identifies the client organisation within the PaymentsPlus Platform. |

| 5 | Customer Name | 24 | 30 | Yes | Char Left Justified Space Filled | Customer Name as provided by Westpac (for human readable purposes only). |

| 6 | File Identifier | 54 | 12 | No | Char Left Justified Space Filled | A unique identifier for the file - this will be formatted as the text RA followed by the file creation date suffixed by the file sequence number. I.e. RAYYYYMMDD## For Dishonour files this value will be blank. |

| 7 | File Invoice Sign | 66 | 1 | Yes | + or - |

By default, + indicates an invoice, - indicates a credit note. However, if the file invoice sign is negative (-), this is reversed (+credit notes, -invoice) for all payments in the file. |

3 - Batch Header record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 3 |

Record Type |

| 2 | Customer Code | 2 | 15 | Yes | Char Left Justified Space Filled | Customer Code as provided by Westpac. This code uniquely identifies the client organisation within the PaymentsPlus Platform. |

| 3 | Batch Reference | 17 | 20 | Yes | Char Left Justified Space Filled | This will be the reference which appears on the Customer bank statement. This value only applies to BUYER REPAYMENT and SUPPLIER MATURITY PAYMENT remittance batches. |

| 4 | Amount Sign | 37 | 1 | Yes | + or - |

The sign for the amount of this payment. |

| 5 | Amount | 38 | 14 | Yes | Number Right Justified Zero Filled | Amount of credit / debit to the customer's account in cents. |

| 6 | Currency | 52 | 3 | Yes | Char Left Justified Space Filled | ISO standard 3 letter currency code for the currency of this payment. |

| 7 | Remittance Date | 55 | 8 | Yes | Date YYYYMMDD | The date of the debit or credit for this payment. |

| 8 | Remittance Type | 63 | 25 | Yes | Char Left Justified Space Filled | Defines the type of batch. Valid values: DISHONOUR, BUYER REPAYMENT, SUPPLIER PAYMENT, SUPPLIER MATURITY PAYMENT |

5 - Invoice Detail record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 5 |

Record Type |

| 2 | Supplier Code | 2 | 15 | Yes | Char Left Justified Space Filled | The supplier who generated the invoice. |

| 3 | Invoice Number | 17 | 25 | Yes | Char Left Justified Space Filled | The unique invoice number. |

| 4 | Invoice Date | 42 | 8 | Yes | Date YYYYMMDD | The date the invoice was generated by the supplier. |

| 5 | Invoice Amount Sign | 50 | 1 | Yes | + or - |

See File Invoice Sign (File Control Header Record) for further details on what to populate in this field. Default + for invoice, - for credit note |

| 6 | Invoice Amount | 51 | 9 | Yes | Number Right Justified Zero Filled | Amount of original invoice. |

| 7 | Currency | 60 | 3 | Yes | Char Left Justified Space Filled | ISO standard 3 letter currency code for the currency of this payment. |

| 8 | Paid Amount | 63 | 9 | Yes | Number Right Justified Zero Filled | Actual amount paid (ie. discounted amount for early settlements, full invoice value for due date settlements). |

| 9 | Margin Amount | 72 | 9 | Yes | Number Right Justified Zero Filled | Buyer margin share amount. |

| 10 | Payment Reference | 81 | 20 | No | Char Left Justified Space Filled | Customer payment reference field. |

7 - Batch Footer record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 7 |

Record Type |

| 2 | Invoice Record Count | 2 | 6 | Yes | Number Right Justified Zero | Filled Count of all 5 records. |

| 3 | Invoice Total Amount Sign | 8 | 1 | Yes | + or - |

Sign for Invoice Total Amount. |

| 4 | Invoice Total Amount | 9 | 14 | Yes | Number Right Justified Zero Filled | Total amount in cents of all invoice records in this batch. |

| 5 | Batch Reference | 23 | 20 | Yes | Char Left Justified Space Filled | Batch Reference as per Batch Header Record. See Batch Header Record. |

9 - File Control Footer record

| Field | Field Name | Position | Length | Required | Format | Description |

|---|---|---|---|---|---|---|

| 1 | Record Type | 1 | 1 | Yes | 9 |

Record Type |

| 2 | Batch Record Count | 2 | 2 | Yes | Number Right Justified Zero Filled | Count of all 3 records in the entire file. |

| 3 | Invoice Record Count | 10 | 8 | Yes | Number Right Justified Zero Filled | Count of all 5 records in the entire file. |

| 4 | Invoice Total Amount Sign | 18 | 1 | Yes | + or - |

Sign for Invoice Total Amount. |

| 5 | Invoice Total Amount | 19 | 11 | Yes | Number Right Justified Zero Filled | Total amount in cents of all invoice records in this file. |

Sample file

1201306181347WBC003 WBC003 RA2013061803+

3WBC003 1173913002 -00000000005400AUD20130701SUPPLIER MATURITY PAYMENT

5WBC003SUP01 Inv_001001 20101201+000001000AUD000001000000000000

5WBC003SUP01 Inv_001002 20101201+000001100AUD000001100000000000

5WBC003SUP01 Inv_001003 20101201+000001200AUD000001200000000000

5WBC003SUP01 Inv_001004 20101201-000001200AUD000001200000000000

5WBC003SUP01 Inv_002001 20101201+000001000AUD000001000000000000

5WBC003SUP01 Inv_002002 20101201+000001100AUD000001100000000000

5WBC003SUP01 Inv_002003 20101201+000001200AUD000001200000000000

7000007+000000000054001173913002

901 00000007+00000005400